net investment income tax 2021 trusts

All About the Net Investment Income Tax. 2021 tax rates schedules and contribution limits Tax.

Net Investment Income Tax Niit Quick Guides Asena Advisors

Form 1041 - Net Investment Income.

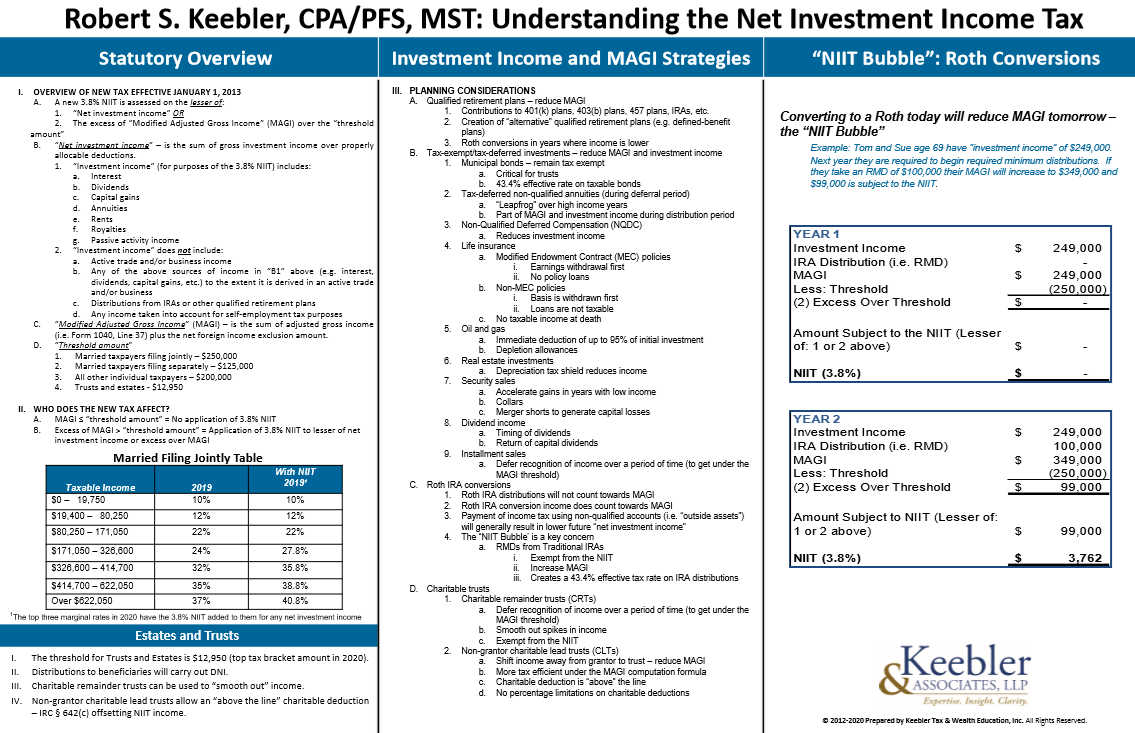

. Learn How EY Can Help. This tax only applies to high-income. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

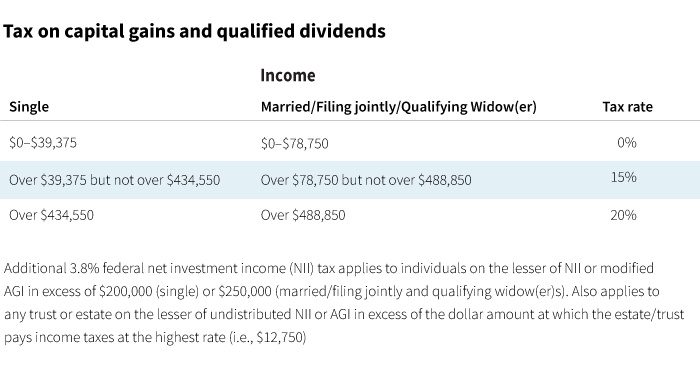

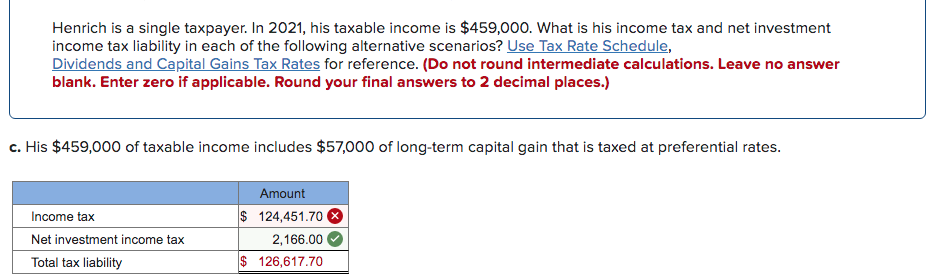

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. Therefore the QFT has two beneficiary contracts with net investment income in excess of the threshold amount for the year. So for example if a trust earns 10000 in income during 2022 it would pay the following taxes.

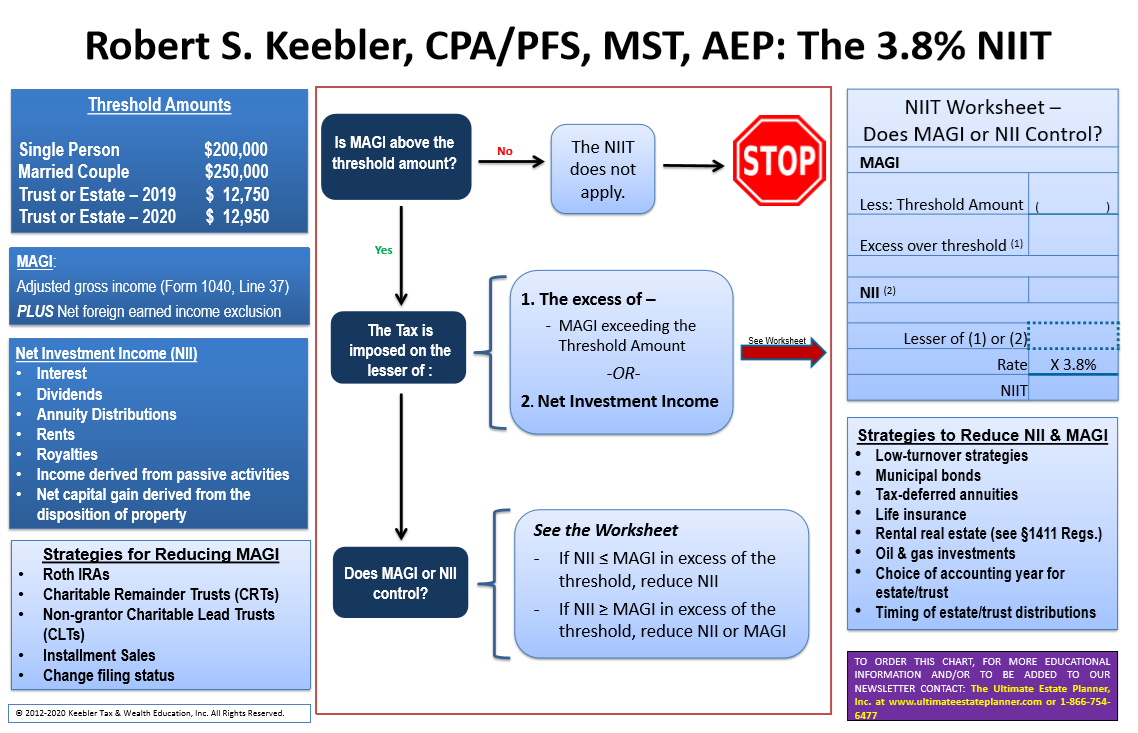

Section 1411 imposes a non-deductible 38 tax on net investment income of individuals estates and trusts that have income above specified thresholds as follows. Subject to a 38 unearned income. If taxable income is.

Rachel Blakely-Gray Jul 15 2021. Trusts undistributed net investment income is 25000 which is Trusts net. The 38 net investment income tax is a surtax meaning it is imposed independently on net investment income that is also subject to any other applicable income tax.

In 2022 the federal government taxes trust income at four levels. Here the 5000 of capital gain excluded from DNI clearly net investment income is added to the 22500 of net investment income retained by the trust. The threshold amount for the 2021 tax year is 13050.

Lets say you have 30000 in net investment income and your magi goes over the threshold by 50000. The highest trust and estate tax rate is 37. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the magi threshold only 13050 for.

In 2021 the federal government taxes trust income at four levels. Ad From Fisher Investments 40 years managing money and helping thousands of families. All about the net investment income tax.

When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that went into effect for this. Ad Estate Trust Tax Services. Thus the total amount.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately. Names shown on your tax return. Since 2013 certain higher-income individuals have been.

Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. 2021 Ordinary Income Trust Tax Rates. 1 It applies to individuals families estates.

The estates or trusts portion of net. It applies to income of 13050 or more for deaths that occurred in 2021. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office.

The rate remains 40 percent. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The 38 Tax You May Need to Worry About.

Ad Estate Trust Tax Services. If you profit from your investments this ones for you. This election is.

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net. 24 of 7099 all. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office.

Generally net investment income includes gross income from interest dividends annuities and royalties. The tax rate schedule for estates and trusts in 2021 is as follows. Trusts 60000 of taxable income attributable to the IRA is excluded from net investment income.

The tax rate works out to be 3146 plus 37 of income. Trusts 2650 9550 265 24 2650 9550 13050 1921 35 9550. Section 6013g election see instructions.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. The 38 Net Investment Income Tax. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Youre responsible for paying capital gains. IRS and Social Security Administration updates 2021. 10 of 2750 all earnings between 0 2750 275.

Share on Twitter. Learn How EY Can Help. Net Investment Income Tax 2021 Form.

Client Friendly Charts Handouts Archives Ultimate Estate Planner

Irs Form 8960 Fill Out Printable Pdf Forms Online

Applying The New Net Investment Income Tax To Trusts And Estates

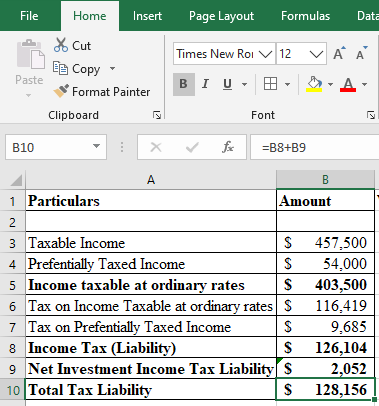

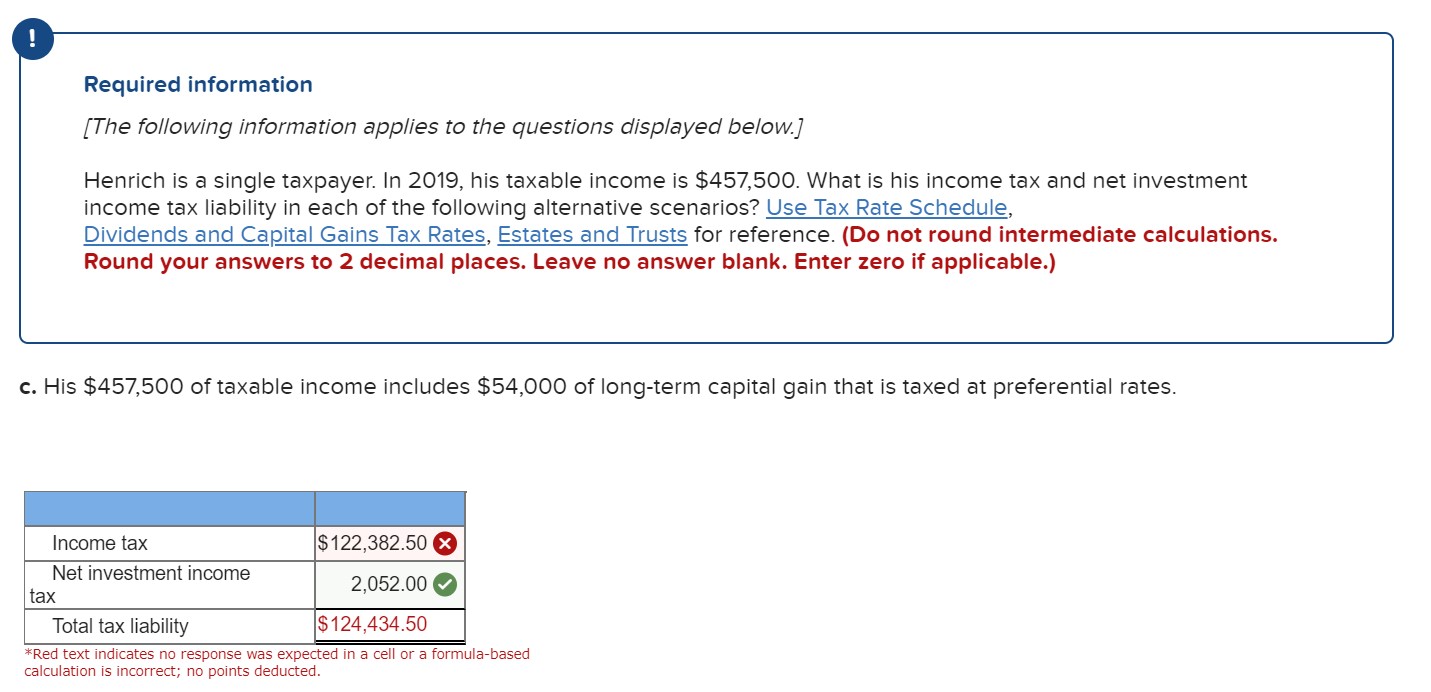

Answered Required Information The Following Bartleby

What Is Net Investment Income Tax Overview Of The 3 8 Tax

How To Calculate The Net Investment Income Properly

What Is The The Net Investment Income Tax Niit Forbes Advisor

Affordable Care Act Tax Law Changes For Higher Income Taxpayers Taxact Blog

How To Calculate The Net Investment Income Properly

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

What Is The Net Investment Income Tax Caras Shulman

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Net Investment Income Tax For 1040 Filers Perkins Co

Gauge Your Tax Bracket To Drive Tax Planning At Year End

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

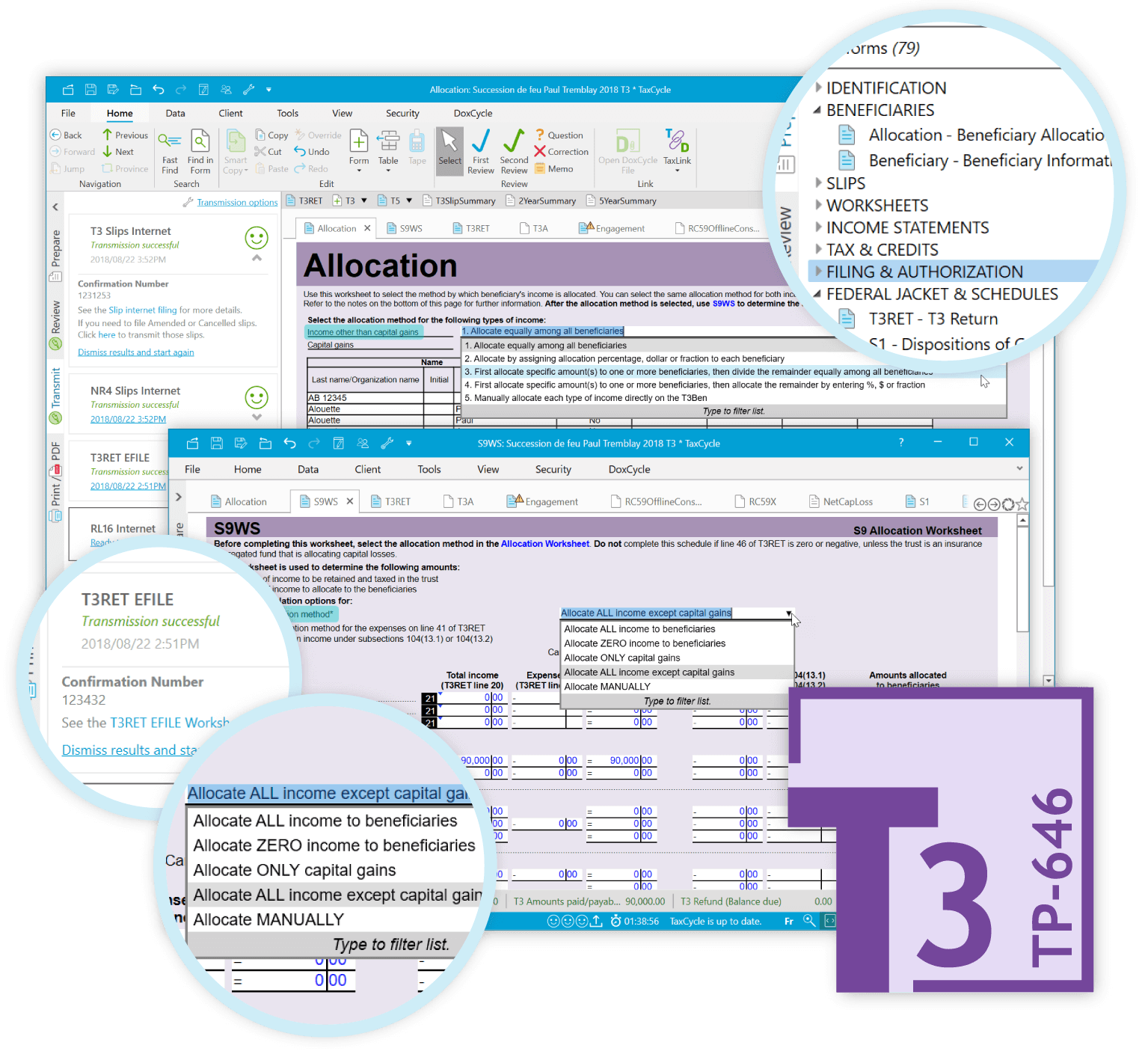

Taxcycle T3 Trust Returns Taxcycle

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp