tax refund calculator ontario 2022

We strive for accuracy but cannot guarantee it. 2021 2022 tax.

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

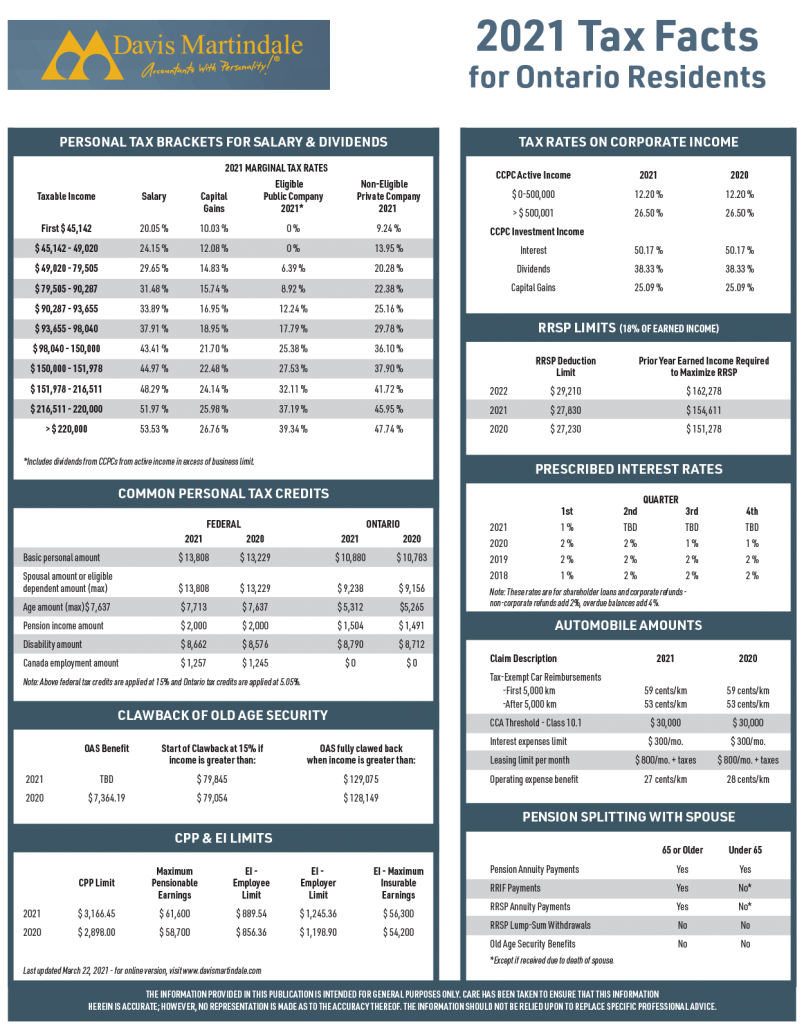

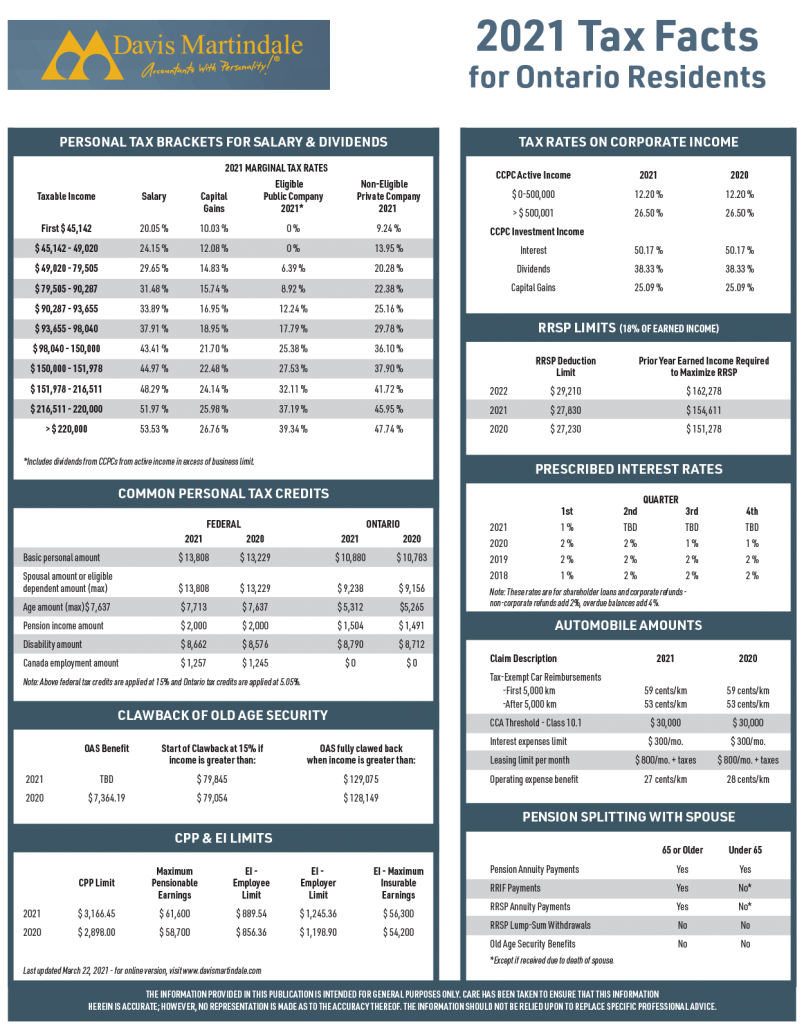

2021 2022 tax brackets and most tax credits have been verified to canada revenue agency and provincial factors.

. Calculate the total income taxes of the Ontario residents for 2022. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The canada annual tax calculator is updated for the 202122 tax year.

The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142. Province Tax Year Salary Rate Work. That means that your net pay will be 40568 per year or 3381 per month.

The income tax calculator estimates the refund or potential owed amount on a federal tax return. The period reference is. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget.

This calculator is for 2022 Tax Returns due in 2023. Calculate the tax savings your RRSP contribution generates in each province and territory. Your average tax rate is.

2022 Ontario Income Tax Calculator Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes. 8 weeks when you file a paper return. This calculator is for 2022 tax returns due in 2023.

Calculations are based on rates known as of october 28 2021. The calculator reflects known rates as of January 15 2022. Income tax calculator 2022 - Ontario - salary after tax Income tax calculator Ontario Find out how much your salary is after tax Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 52000 Federal tax deduction - 7175 Provincial tax deduction - 3282 CPP deduction.

The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475. Also is a tool for reverse sales tax calculation. These timelines are only valid for returns that we received.

Use your taxable income to. If you make 52000 a year living in the region of ontario canada you will be taxed 11432that means that your net pay will be. Ontario Income Tax and Benefit Return Calculator for 202223 T1 General - 2022 Ontario Income Tax and Benefit Return This is the Income Tax and Benefit Return calculator relevant to.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. If your net income for the year will be between 40495 and 76762 and you want to calculate a partial claim get Form TD1ON-WS Worksheet for the 2022 Ontario Personal Tax. 2022 RRSP savings calculator.

The government has proposed to deliver CAI payments on a quarterly basis starting this year. Reflects known rates as of January 15 2022. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

You can also create your new 2022 W-4 at the end of the tool on the tax. 2 Allowances earnings tips directors fees etc 2022. 8 rows Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and. The Canada Revenue Agencys goal is to send your refund within.

Province of residence Employment income Self-employment. 2 weeks when you file online. Enter your filing status income deductions and credits and we will estimate your total taxes.

The maximum tax refund is 4000 as the property is over 368000. Payments will start in July 2022 with a double-up payment that will return. The second tax bracket at 915 is increasing to an upper.

1 Salary or wages 2022. Tax Refund Calculator 2022 Ontario. 3 Employer lump sum payments 2022.

How To File Income Tax Return To Get Refund In Canada 2022

2021 2022 Income Tax Calculator Canada Wowa Ca

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Property Marketing Stamp Duty Investing

In The United States The Internal Revenue Service Requires That Individual Taxpayers Who Have Not Had Sufficie Inheritance Tax Tax Deductions Tax Free Savings

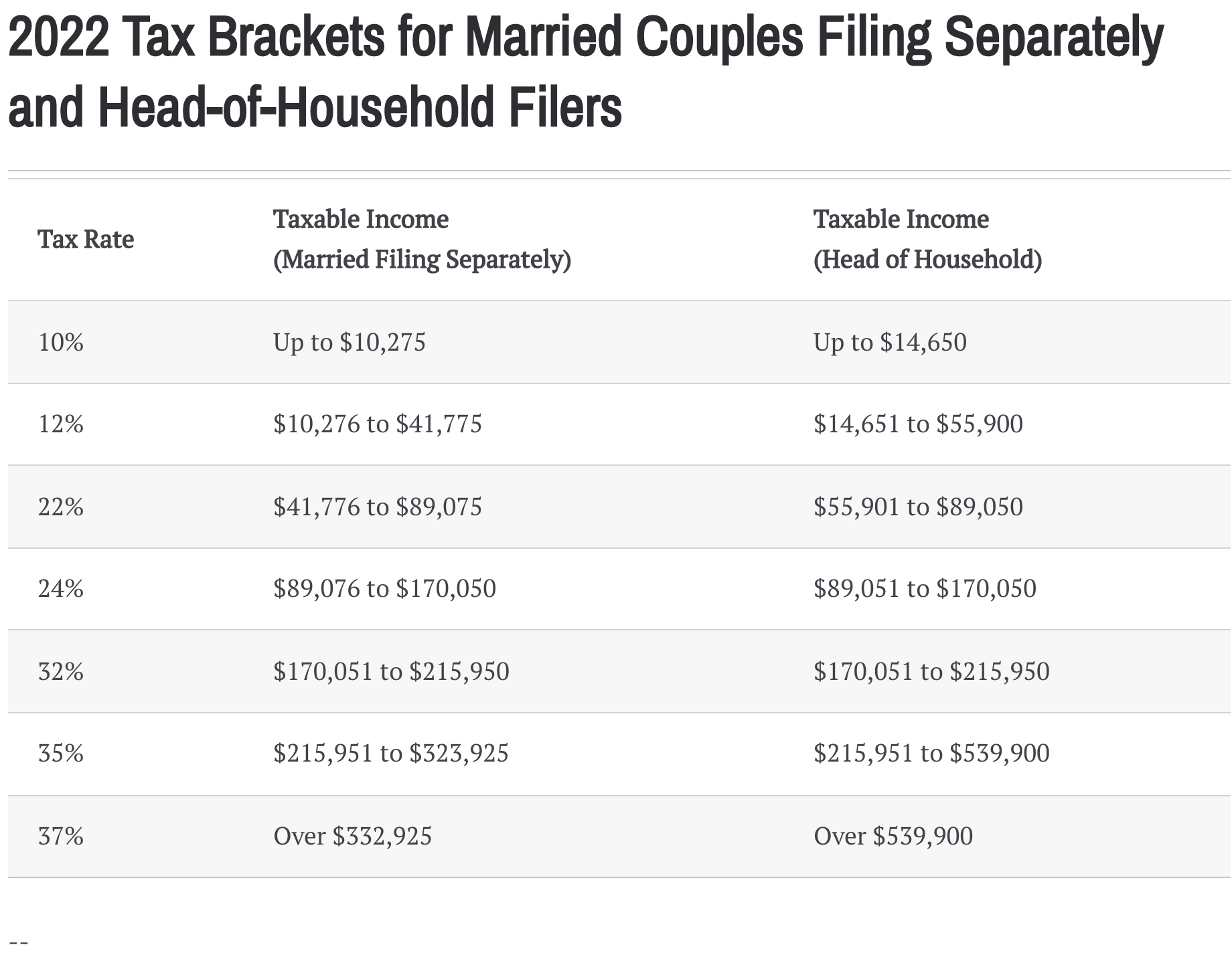

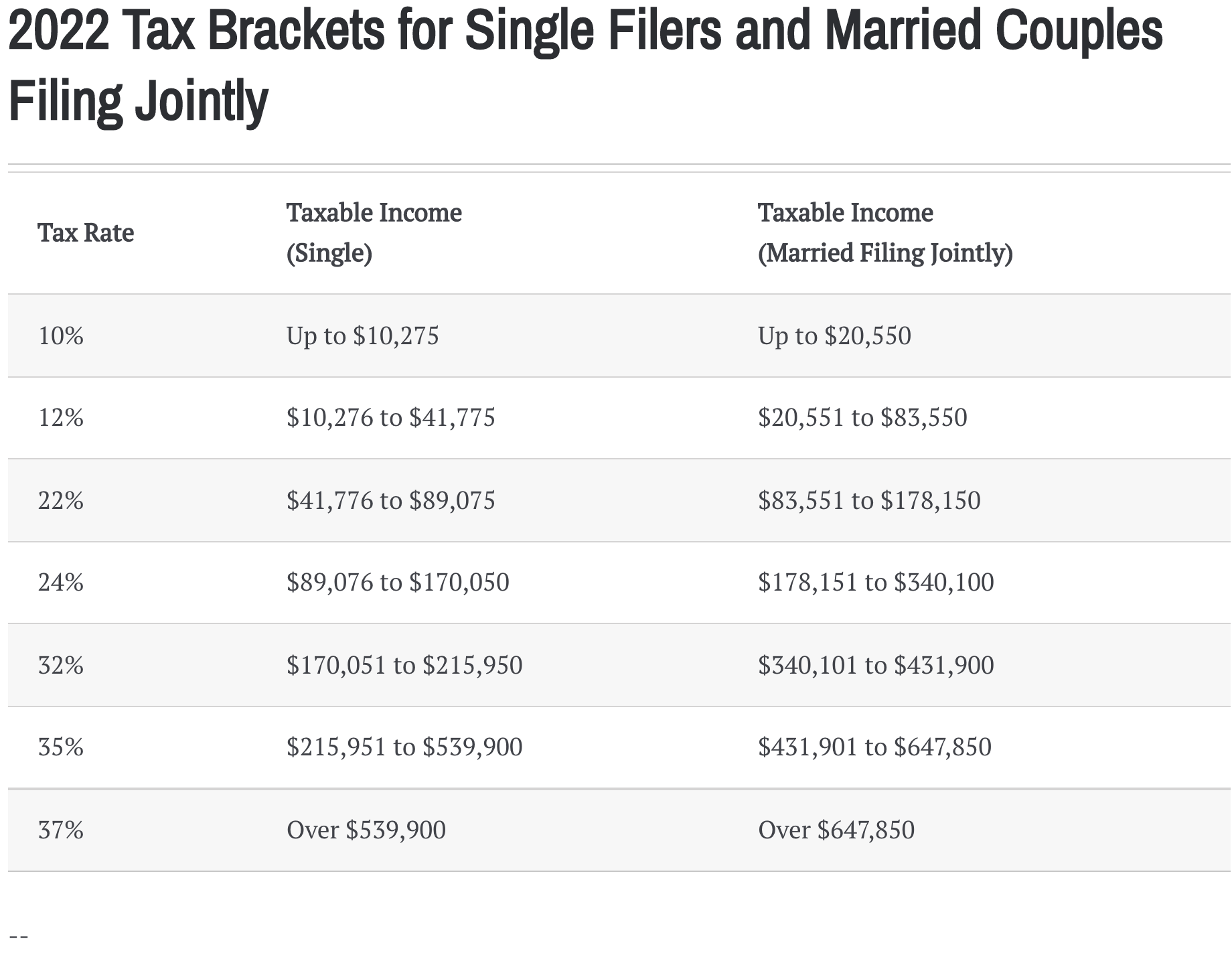

Income Tax Brackets For 2022 Are Set

Income Tax Brackets For 2022 Are Set

Simple Tax Calculator For 2021 Cloudtax

Capital Gains And Losses Taxes On Investment Property Sale 2019 In 2022 Investment Property Financial Strategies Tax Questions

Ontario Income Tax Calculator Wowa Ca

Are You Making The Profit You Think You Re Making If You Need To Calculate Your Sale Price From Your Costs To Mak Accounting Firms Accounting Business Advisor

2019 Canadian Tax Tips My Road To Wealth And Freedom Canadian Money Tax Refund Finances Money

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

2021 Tax Facts For Ontario Residents Davis Martindale

Tax Filing Season 2022 What To Do Before January 24 Marca

Your 2022 Tax Fact Sheet And Calendar Morningstar

Starling Bank Logo Banks Logo Finance Logo Letter Logo Design

Phelps Woman Arrested For Dwi In 2022 State Police Police Arrest